Predatory Loans At The Doctor's Office

Helping patients or trapping them?

This is a curious research letter highlighting an apparently new trend in health expense financing: “medical credit cards”.

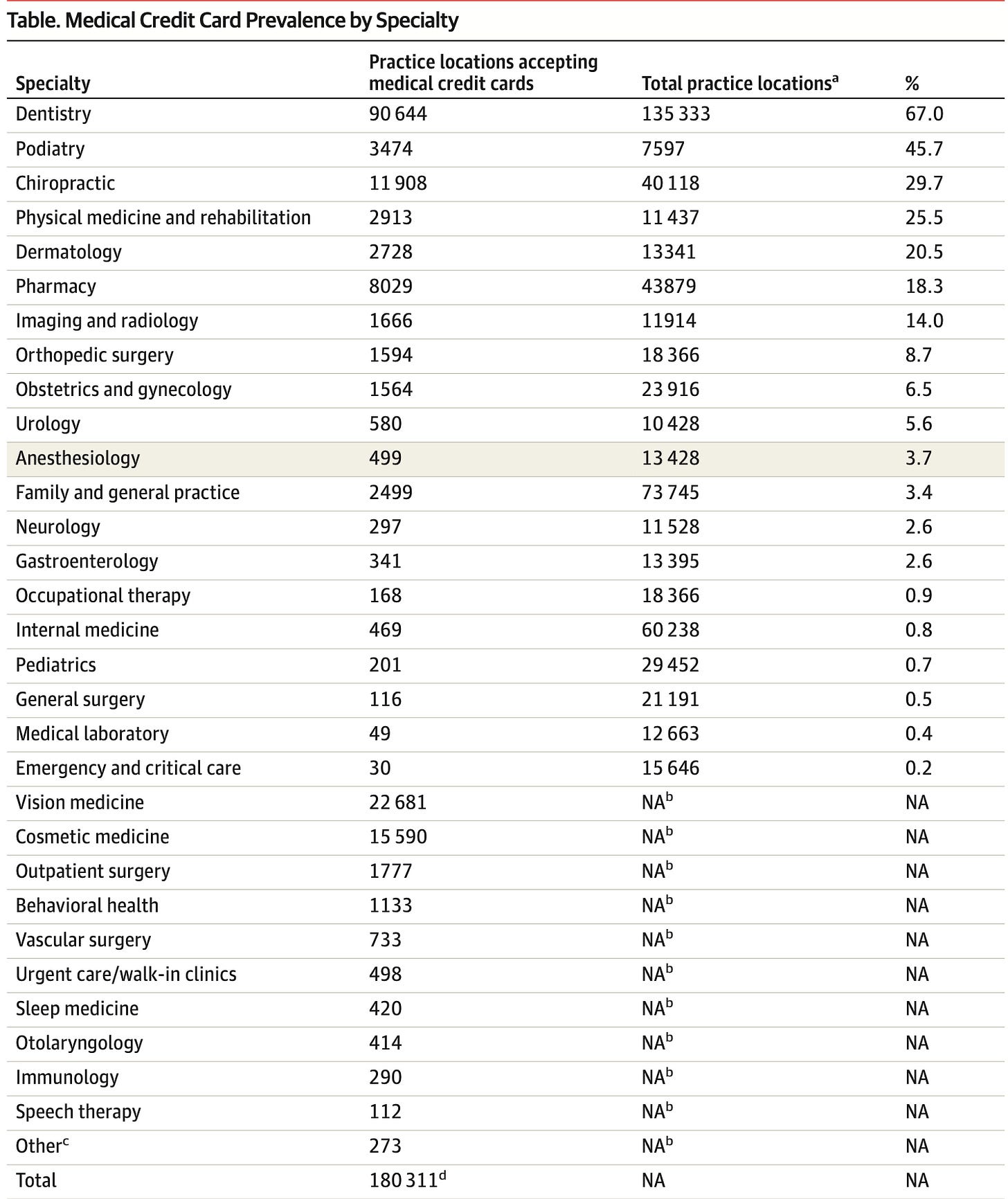

These are credit cards issued by banks specifically for the purposes of health and medical expenses and differ, somewhat, from traditional credit cards in that there is an initial interest-free period. As the table above shows, they are most often issued – sometimes in partnership – with dental, podiatric, and chiropractic services, although a smattering of other elective-appearing offices are featured.

While it seems reasonable to consider this sort of financing advantageous, the only group making out ahead with certainty is the physician group collecting full fees up-front. Patients, on the other hand, after the initial interest holiday, are typically hit with the entirety of accrued interest retroactively – representing a quarter of patients paying fees by this mechanism.

Yet another glorious mechanism for financial toxicity in American healthcare.