"Private Equity Is Evil" (again)

They certainly pay less, anyway.

The superficial reading of this analysis says: private equity pays less, kills more.

It’s a differences-in-differences longitudinal analysis of hospital salaries and inpatient performance following private equity acquisition, as compared to matched hospitals not acquired by PE.

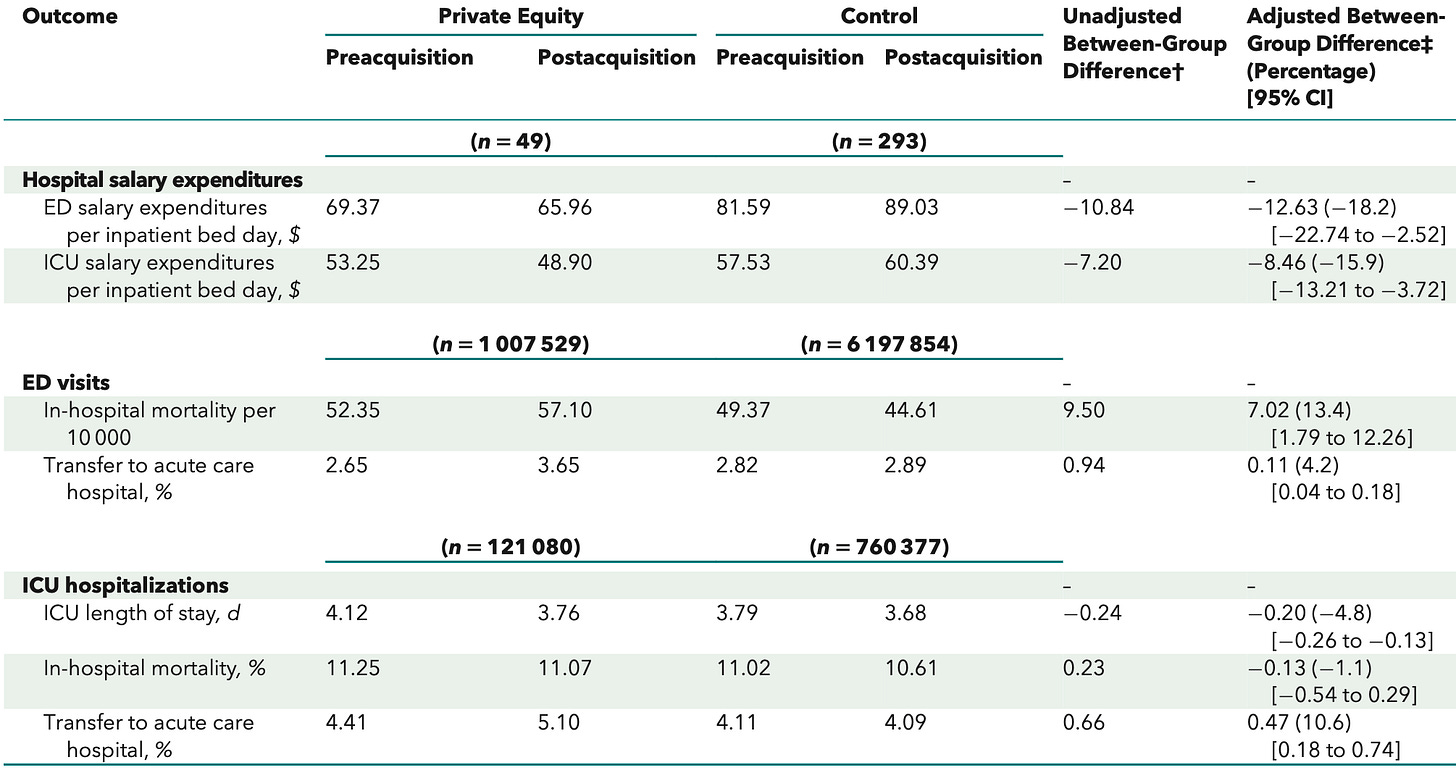

The main results are:

Salary expenditures come from RAND Cost Report data, outcomes from Medicare claims.

Overall, PE-acquired hospitals spent less on their ED and ICU staff following acquisition, while non-PE hospitals increased expenditures. There are some signals of 1) harm, see: inpatient mortality per 10,000 ED visits, and 2) increased transfers out.

There are lots of assumptions and holes in these data, as “private equity” is not homogenous, Medicare outcomes do not necessarily generalize to the remainder of the hospital population, and ED and ICU salary lines in isolation likewise do not necessarily generalize to the rest of the hospital. These data have face validity, but it’s also consistent with a narrative of demonizing PE most folks would readily assume. Further, confirmatory, research is necessary to solidify this evidence.

Can you share the citation? I might be missing it but I can't find a link to the article nor find it on a quick PubMed search.